Social Security payments in June 2026 follow a fully standard schedule, with five separate deposit dates covering SSI, SSDI, retirement, and survivor beneficiaries.

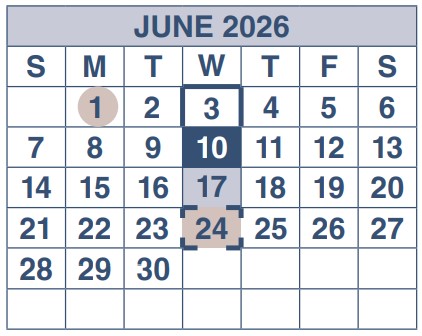

The Social Security Administration (SSA) will distribute payments on Monday, June 1, 2026; Wednesday, June 3, 2026; Wednesday, June 10, 2026; Wednesday, June 17, 2026, and Wednesday, June 24, 2026.

Most people’s question about June 2026 payments is whether Juneteenth delays deposits. The answer is no. Juneteenth falls on Friday, June 19, 2026 — between the June 17 and June 24 payment dates. No Social Security payment is scheduled for June 19. All five deposit dates are processed on their normal schedule without interruption.

June 2026 is also notable for a different reason. In June 2025, the SSI payment was issued on Friday, May 30, 2025, because June 1 fell on a Sunday, leaving no SSI payment in June that year. June 2026 reverses that. June 1, 2026, falls on a Monday, a standard business day, so SSI issues normally on June 1. Beneficiaries who experienced confusion in June 2025 can expect a fully predictable schedule this month.

All June 2026 payments already include the 2.8% Cost-of-Living Adjustment (COLA) that took effect on January 1, 2026.

This article covers the complete Social Security payment schedule for June 2026 by recipient group, exact deposit amounts, the Juneteenth holiday impact on SSA offices, extra payment facts, summer earnings rules for SSDI and SSI recipients, and an early outlook on the 2027 COLA.

Table of Contents

June 2026 Social Security Payment Schedule at a Glance

The SSA distributes Social Security payments in June 2026 across five dates, determined by recipient type and date of birth. This schedule applies to retirement benefits, SSDI, and survivor benefits.

| Recipient Group | June 2026 Payment Date | Day of Week | Juneteenth Impact? |

|---|---|---|---|

| SSI Recipients | Monday, June 1, 2026 | Monday | None |

| Pre-May 1997 Beneficiaries | Wednesday, June 3, 2026 | Wednesday | None |

| Birthdays: 1st – 10th of any month | Wednesday, June 10, 2026 | Wednesday (2nd) | None |

| Birthdays: 11th – 20th of any month | Wednesday, June 17, 2026 | Wednesday (3rd) | None — paid before holiday |

| Birthdays: 21st – 31st of any month | Wednesday, June 24, 2026 | Wednesday (4th) | None — paid after the holiday |

Juneteenth (Friday, June 19, 2026) falls between the third and fourth Wednesday payment cycles. The SSA’s payment adjustment rules only activate when a federal holiday falls directly on a scheduled payment date. Because no payment is scheduled on June 19, neither the June 17 nor the June 24 payment is affected.

How the SSA Birthdate Payment System Works

The SSA implemented its birthdate-based schedule in May 1997. The day of the month a beneficiary was born — not the year — determines which Wednesday they receive payment each month. A retired worker born on February 8 receives payment on the second Wednesday of every month (Wednesday, June 10, 2026).

A disabled worker born on September 23 receives payment on the fourth Wednesday (Wednesday, June 24, 2026). This schedule applies uniformly to retirement benefits, SSDI, and survivor benefits for all beneficiaries who became entitled after April 30, 1997.

SSI Payment Date June 2026

When Will SSI Be Deposited in June 2026?

SSI payments in June 2026 will be deposited on Monday, June 1, 2026. Because June 1 falls on a standard business day, the SSA issues Supplemental Security Income on the first of the month as scheduled.

June 2026 vs. June 2025 — A Critical Difference

June 2025 produced a significant scheduling anomaly. June 1, 2025, fell on a Sunday, which triggered the SSA’s weekend adjustment rule. The SSA issued the June 2025 SSI payment on Friday, May 30, 2025 — meaning SSI recipients received no payment in June 2025 at all. Recipients who received a deposit on May 30, 2025, received their June SSI payment early.

June 2026 does not repeat this pattern. June 1, 2026, is a Monday. No early adjustment is triggered. SSI recipients receive their standard June 2026 payment on Monday, June 1, 2026, and their standard July 2026 payment on Wednesday, July 1, 2026. There is no skipped month and no early advance payment.

Is There a Double or Early SSI Payment in June 2026?

No. There is no double, early, or extra SSI payment in June 2026. The SSA only issues SSI payments early when the first of the month falls on a weekend or federal holiday. June 1, 2026, is a Monday, so no early advance payment applies.

The months in 2026 that produced or will produce early SSI payments are January (paid December 31, 2025), February (paid January 30, 2026), March (paid February 27, 2026), August (paid July 31, 2026), and November (paid October 30, 2026). June is not among them.

Any online claim about a June 2026 bonus SSI check or double payment is not confirmed by the Social Security Administration.

How Much Is the SSI Payment in June 2026?

The maximum federal SSI payment in June 2026 is $994 per month for an eligible individual and $1,491 per month for an eligible couple. These amounts reflect the 2.8% COLA applied on January 1, 2026.

| SSI Recipient Category | 2025 Monthly Amount | 2026 Monthly Amount | Monthly Increase |

|---|---|---|---|

| Individual | $967 | $994 | +$27 |

| Couple | $1,450 | $1,491 | +$41 |

| Essential Person | $484 | $498 | +$14 |

Actual SSI payment amounts vary based on countable income, living arrangements, and state supplemental programs. The figures above represent the federal SSI maximum. Many states pay an additional amount on top of the federal benefit.

SSDI Payment Dates June 2026

When Will SSDI Payments Be Deposited in June 2026?

SSDI payments in June 2026 will be deposited on Wednesday, June 3, Wednesday, June 10, Wednesday, June 17, or Wednesday, June 24, 2026, depending on when the beneficiary first became entitled and their date of birth.

- Wednesday, June 3, 2026 — Recipients who became entitled to SSDI before May 1997, or who receive both SSI and SSDI simultaneously.

- Wednesday, June 10, 2026 — SSDI recipients born on the 1st through the 10th of any month.

- Wednesday, June 17, 2026 — SSDI recipients born on the 11th through the 20th of any month.

- Wednesday, June 24, 2026 — SSDI recipients born on the 21st through the 31st of any month.

None of these dates is affected by the Juneteenth federal holiday on Friday, June 19. All four SSDI deposit dates are processed on their normal schedule.

How Much Will SSDI Recipients Receive in June 2026?

The average SSDI payment in June 2026 is $1,630 per month, after the 2.8% COLA applied in January 2026. All June 2026 SSDI payments already reflect this increase. No additional mid-year adjustment is scheduled.

| SSDI Benefit Category | 2025 Monthly Amount | 2026 Monthly Amount | Monthly Increase |

|---|---|---|---|

| Average Disabled Worker | $1,586 | $1,630 | +$44 |

| Maximum SSDI (at Full Retirement Age) | $4,018 | $4,152 | +$134 |

2026 Trial Work Period Threshold for SSDI Recipients

The SSA uses the Trial Work Period (TWP) to allow SSDI recipients to test their ability to work without immediately losing benefits. In 2026, a month counts as a TWP month when a recipient earns $1,210 or more in that month. June is the beginning of summer hiring, making this threshold particularly relevant for SSDI recipients who take on seasonal or part-time employment.

Earning above $1,210 in June triggers a TWP month but does not immediately stop SSDI payments. The SSA allows up to nine TWP months within a rolling 60-month period before benefits are subject to review. After nine TWP months, the SSA evaluates whether earnings exceed the Substantial Gainful Activity (SGA) limit of $1,690 per month for non-blind recipients.

Social Security Retirement Benefit Payment Dates June 2026

When Will Retirees Get Paid in June 2026?

Retired workers receive their June 2026 Social Security payments on Wednesday, June 3, Wednesday, June 10, Wednesday, June 17, or Wednesday, June 24, 2026, depending on their date of birth and enrollment date.

Retirees who began receiving benefits before May 1997 are paid on Wednesday, June 3, 2026. All other retired workers are paid on the second, third, or fourth Wednesday of June based on their birth date. For example, a retiree born on March 5 receives payment on Wednesday, June 10. A retiree born on October 15 receives payment on Wednesday, June 17. A retiree born on July 29 receives payment on Wednesday, June 24.

Average and Maximum Social Security Retirement Benefits in June 2026

The average Social Security retirement benefit in June 2026 is $2,071 per month, reflecting the 2.8% COLA applied beginning January 2026.

| Retirement Benefit Category | 2025 Monthly Amount | 2026 Monthly Amount | Monthly Increase |

|---|---|---|---|

| Average Retired Worker | $2,015 | $2,071 | +$56 |

| Maximum Benefit at Full Retirement Age | $4,018 | $4,152 | +$134 |

| Maximum Benefit at Age 70 | $4,918 | $5,181 | +$263 |

Net June 2026 Check After Medicare Part B Deduction

Most Social Security retirement beneficiaries have the Medicare Part B premium deducted automatically before their payment is deposited. The standard Medicare Part B premium for 2026 is $202.90 per month — up $17.90 from the 2025 premium of $185.00.

| Item | Monthly Amount |

|---|---|

| 2026 COLA Increase (2.8%) | +$56.00 |

| Medicare Part B Premium Increase | −$17.90 |

| Net Monthly Increase for Average Retiree | +$38.10 |

Recipients subject to IRMAA (Income-Related Monthly Adjustment Amount) surcharges pay higher Part B premiums and see a smaller net monthly gain.

Full Retirement Age Milestone — June 2026

Workers born in June 1959 reach Full Retirement Age (67 years and 0 months) in June 2026. Reaching FRA has two significant effects. First, the earnings test — which withholds $1 in benefits for every $2 earned above $24,480 per year for beneficiaries under FRA — no longer applies. Second, benefits are no longer permanently reduced for exceeding earning limits in prior months. Workers born in June 1959 who continued working past their FRA may see their benefit amount recalculated upward beginning in June 2026.

Does Juneteenth Affect Social Security Payments in June 2026?

H4: The Direct Answer — Juneteenth Does Not Delay Any June 2026 Social Security Payment

Juneteenth (Friday, June 19, 2026) does not delay or reschedule any Social Security or SSI payment in June 2026. All five June payment dates — Monday, June 1, Wednesday, June 3, Wednesday, June 10, Wednesday, June 17, and Wednesday, June 24 — are unaffected by the federal holiday.

The SSA’s payment adjustment rule applies only when a scheduled payment date falls on a federal holiday. Because no payment is scheduled for Friday, June 19, the holiday does not affect the payment calendar. The June 17 payment processes three days before the holiday. The June 24 payment processes five days after it.

| Payment Date | Days From Juneteenth (June 19) | Status |

|---|---|---|

| Monday, June 1 | 18 days before | Unaffected |

| Wednesday, June 3 | 16 days before | Unaffected |

| Wednesday, June 10 | 9 days before | Unaffected |

| Wednesday, June 17 | 2 days before | Unaffected |

| Wednesday, June 24 | 5 days after | Unaffected |

What Juneteenth Does Affect — SSA Field Offices and Phone Lines

All SSA field offices across the United States will be closed on Friday, June 19, 2026. The SSA’s national phone line (1-800-772-1213) will also be unavailable on June 19.

Recipients who need to contact the SSA regarding a pending application, address change, overpayment dispute, or benefit verification should do so by Thursday, June 18, 2026, or wait until Monday, June 22, 2026.

The SSA’s My Social Security online portal at ssa.gov remains available 24 hours a day, including on Juneteenth. The following transactions are available online without a phone call or office visit:

- View and print benefit verification letters

- Update direct deposit information

- Change the address of record

- Review payment history and scheduled deposits

- Respond to SSA notices

- Check Social Security Fairness Act (SSFA) adjustment status

As of 2026, the SSA has reduced in-person service capacity at field offices nationwide. Scheduling an appointment before visiting any field office is strongly recommended, particularly around federal holidays when appointment slots fill quickly in the surrounding weeks.

Is Social Security Sending Extra or Bonus Payments in June 2026?

No Bonus Checks — The Facts for June 2026

The SSA has not authorized any bonus, extra, or supplemental Social Security payments for June 2026. Widespread online claims about additional June checks are not confirmed by the Social Security Administration.

The three most common sources of confusion are the same as in prior months:

- Early SSI payment misconceptions. The series of early SSI deposits in the first quarter of 2026 — January (paid December 31, 2025), February (paid January 30, 2026), and March (paid February 27, 2026) — led some recipients to expect continued extra payments. June returns to a fully standard schedule.

- Dual beneficiary split deposits. Recipients who receive both SSI and SSDI or retirement benefits receive two separate June deposits — SSI on Monday, June 1, and SSDI or retirement on their birthdate, Wednesday. This is a standard, expected pattern.

- Social Security Fairness Act retroactive adjustments. Some public-sector retirees affected by the elimination of WEP and GPO may receive an unexpected lump-sum deposit in 2026. If this occurs in June, it is a legitimate SSA adjustment payment, not a bonus check.

Social Security Fairness Act — Could You See an Unexpected June 2026 Deposit?

The Social Security Fairness Act (SSFA), signed on January 5, 2025, eliminated the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO) for public-sector employees — including teachers, police officers, firefighters, and other government workers whose pensions came from employment not covered by Social Security payroll taxes.

The SSA began processing revised monthly benefit amounts and retroactive lump-sum payments for eligible recipients in early 2025. Q2 2026 remains an active processing window. Some recipients with complex cases or late-filed claims may still be receiving their first adjusted deposits in June 2026.

A retroactive SSFA lump-sum payment is separate from the regular monthly benefit and will appear as a distinct deposit on the recipient’s bank statement. It is taxable income in the year received. Recipients awaiting SSFA adjustments who have not yet received a corrected benefit or lump sum should contact the SSA at 1-800-772-1213 (not available June 19) or check their My Social Security account at ssa.gov.

Multiple Social Security Payments in June 2026 — When It Is Normal

Dual Beneficiaries — SSI and SSDI or Retirement in June 2026

Recipients who receive both SSI and SSDI or retirement benefits will receive two separate Social Security deposits in June 2026. The SSI payment arrives on Monday, June 1. The SSDI or retirement payment arrives on Wednesday, June 3 (pre-1997 recipients) or on Wednesday, June 10, June 17, or June 24 based on the recipient’s birth date.

This is a standard payment pattern for dual beneficiaries. It is not an error, an overpayment, or a bonus. The SSA coordinates SSI and Social Security payments on different dates by design.

The SSI amount for dual beneficiaries is typically reduced because SSDI or retirement income counts as unearned income in the SSI calculation. After a $20 general income exclusion, the SSA reduces the SSI payment dollar-for-dollar against the SSDI amount.

Pre-1997 Recipients — Up to Three June Deposits

A limited group of beneficiaries may receive three separate deposits in June 2026. This applies to recipients who receive SSI, also qualify for pre-May 1997 Social Security benefits paid on the 3rd of the month, and are additionally entitled to a birthdate-based SSDI or retirement payment.

In June 2026, this group would receive deposits on Monday, June 1 (SSI), Wednesday, June 3 (pre-1997 Social Security), and on their applicable birthdate, Wednesday (June 10, 17, or 24). All three deposits are legitimate. None represents an overpayment or bonus payment.

Recipients uncertain whether multiple deposits are legitimate should log in to My Social Security at ssa.gov and review their “Benefit & Payment Details” to verify the source and amount of each deposit.

2026 COLA Recap and Early 2027 COLA Outlook

How the 2.8% COLA Affects Your June 2026 Social Security Payment

The 2.8% Cost-of-Living Adjustment for 2026 took effect on January 1, 2026. All June 2026 payments fully reflect this increase. No additional mid-year adjustment is scheduled for any month in 2026.

The SSA calculates the annual COLA using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), published by the U.S. Bureau of Labor Statistics. The 2026 COLA of 2.8% exceeds the 2.5% COLA applied in 2025.

| Benefit Type | 2025 Amount | 2026 Amount | COLA Dollar Increase |

|---|---|---|---|

| Average Retired Worker | $2,015/month | $2,071/month | +$56/month |

| Maximum Benefit at Full Retirement Age | $4,018/month | $4,152/month | +$134/month |

| Maximum Benefit at Age 70 | $4,918/month | $5,181/month | +$263/month |

| Average SSDI Recipient | $1,586/month | $1,630/month | +$44/month |

| SSI (Individual) | $967/month | $994/month | +$27/month |

| SSI (Couple) | $1,450/month | $1,491/month | +$41/month |

Early 2027 COLA Outlook — What June 2026 Data Indicates

The Social Security Administration will announce the 2027 COLA in October 2026, after reviewing CPI-W data for the third quarter of 2026 (July, August, and September). However, June marks the point at which Q2 CPI-W data becomes available, giving analysts their first concrete data points for projecting the 2027 adjustment.

The final 2027 COLA cannot be determined until October 2026, when the SSA completes its official calculation. No specific 2027 COLA figure should be cited before that announcement. Recipients searching for “2027 Social Security increase” in June 2026 are searching before any reliable projection is possible. The SSA’s official announcement date remains October 2026.

Summer Work and June 2026 Social Security Benefits

H4: SSDI Recipients — June Earnings and the Trial Work Period

SSDI recipients who begin or increase employment in June 2026 should monitor their earnings against the $1,210 Trial Work Period threshold. June is peak hiring season for summer work. Any month in which a recipient earns $1,210 or more counts as one of the nine allowed TWP months within 60 months.

After nine TWP months, the SSA enters a 36-month Extended Period of Eligibility. During this window, the SSA suspends benefits in any month where earnings exceed the SGA limit of $1,690 per month. SSDI recipients who begin summer work in June should report earnings promptly through My Social Security or the SSA Mobile Wage Reporting app to avoid overpayment notices later in the year.

SSI Recipients — Does Summer Work Reduce the June 2026 Payment?

Earned income in June 2026 does not reduce the June 2026 SSI payment. The SSA uses a two-month lag when calculating how current earnings affect SSI payments. Income earned in June 2026 affects the August 2026 SSI payment. This lag occurs because SSI payments for a given month are calculated based on income from two months prior.

The SSA applies a standard $65 earned income exclusion plus a 50% exclusion on the remaining earned income. For example, a recipient earning $865 in June 2026 would have $400 in countable income ([$865 − $65] ÷ 2), which would reduce their August 2026 SSI payment by $400.

SSI recipients under age 22 who are regularly attending school may exclude up to $2,410 per month in earned income in 2026 under the Student Earned Income Exclusion. The annual cap for this exclusion is $9,750. June marks the end of the academic year for many students, and summer employment income begins accumulating against this annual cap.

What Time Does Social Security Direct Deposit Hit Your Bank in June 2026?

Social Security direct deposits typically post to bank accounts in the early morning hours of the scheduled payment date, generally between midnight and 9:00 a.m. Eastern Time.

For the Monday, June 1, 2026, SSI payment, some banks process ACH transfers over the weekend and make funds available before the business day begins. Most recipients will see funds posted by 9:00 a.m. Eastern Time on June 1.

For Wednesday payments on June 3, June 10, June 17, and June 24, funds are typically available by mid-morning Eastern Time.

Juneteenth (Friday, June 19) does not affect direct deposit processing for the June 24 payment. ACH payments scheduled for Wednesday, June 2,4 settle through normal banking channels on that date without interference from the prior Friday’s federal holiday.

If your bank account does not show the deposit by the afternoon of your scheduled payment date, follow these steps:

- Confirm your correct payment date. Use the table above to verify which June date applies to your recipient group and birth date.

- Check for pending ACH transactions. Contact your bank and ask specifically whether a pending ACH deposit is in process.

- Log in to My Social Security. Visit ssa.gov and select “Benefit & Payment Details” to confirm that the SSA issued the payment on the scheduled date.

- Wait three business days. The SSA requests that recipients wait three business days after the scheduled payment date before reporting a missing payment.

- Contact the SSA. Call 1-800-772-1213 Monday through Friday, 8:00 a.m. to 7:00 p.m. local time. Note that the SSA phone line is unavailable on Friday, June 19. Plan a contact for Thursday, June 18, or Monday, June 22, if your issue falls near the holiday.

Full 2026 Social Security Payment Schedule — Year Calendar

The SSA publishes all monthly payment dates for the full calendar year. The table below lists every Social Security and SSI payment date for 2026.

| Month | SSI Payment Date | Pre-1997 / Dual Beneficiary | Birthday 1–10 | Birthday 11–20 | Birthday 21–31 |

|---|---|---|---|---|---|

| January | Wednesday, January 1 | Friday, January 3 | Wednesday, January 14 | Wednesday, January 21 | Wednesday, January 28 |

| February | Friday, January 30* | Friday, February 6 | Wednesday, February 11 | Wednesday, February 18 | Wednesday, February 25 |

| March | Friday, February 27* | Friday, March 6 | Wednesday, March 11 | Wednesday, March 18 | Wednesday, March 25 |

| April | Wednesday, April 1 | Friday, April 3 | Wednesday, April 8 | Wednesday, April 15 | Wednesday, April 22 |

| May | Friday, May 1 | Friday, May 1† | Wednesday, May 13 | Wednesday, May 20 | Wednesday, May 27 |

| June | Monday, June 1 | Wednesday, June 3 | Wednesday, June 10 | Wednesday, June 17 | Wednesday, June 24 |

| July | Wednesday, July 1 | Friday, July 3 | Wednesday, July 8 | Wednesday, July 15 | Wednesday, July 22 |

| August | Friday, July 31* | Wednesday, August 5 | Wednesday, August 12 | Wednesday, August 19 | Wednesday, August 26 |

| September | Monday, September 1 | Wednesday, September 3 | Wednesday, September 9 | Wednesday, September 16 | Wednesday, September 23 |

| October | Wednesday, October 1 | Friday, October 2 | Wednesday, October 14 | Wednesday, October 21 | Wednesday, October 28 |

| November | Friday, October 30* | Wednesday, November 4 | Wednesday, November 12 | Wednesday, November 18 | Wednesday, November 25 |

| December | Tuesday, December 1 | Wednesday, December 2 | Wednesday, December 9 | Wednesday, December 16 | Wednesday, December 23 |

Frequently Asked Questions — Social Security Payments June 2026

Will Social Security be paid in June 2026?

Yes. The SSA will distribute payments on Monday, June 1, Wednesday, June 3, Wednesday, June 10, Wednesday, June 17, and Wednesday, June 24, 2026, depending on recipient type and date of birth.

Does Juneteenth delay Social Security payments in June 2026?

No. Juneteenth falls on Friday, June 19, 2026 — between the June 17 and June 24 payment dates. No Social Security payment is scheduled for June 19, so no payments are delayed or rescheduled.

When will SSI payments arrive in June 2026?

SSI payments will be deposited on Monday, June 1, 2026. This is a standard on-schedule payment. There is no early or double payment in June.

Why did I get two Social Security payments in June 2026?

If you receive both SSI and SSDI or retirement benefits, you receive two separate deposits — SSI on Monday, June 1, and your SSDI or retirement payment on your birthdate, Wednesday. This is expected and not an error.

Will there be extra or bonus Social Security checks in June 2026?

No. The SSA has not authorized any supplemental or bonus payments for June 2026. Reports of extra checks are not confirmed by the Social Security Administration.

Are SSA offices open on Juneteenth, June 19, 2026?

No. All SSA field offices and phone lines are closed on Friday, June 19, 2026. Use the My Social Security portal at ssa.gov for account transactions on that date, or contact the SSA by Thursday, June 18, or Monday, June 22.

What is the maximum Social Security retirement benefit in June 2026?

The maximum retirement benefit for someone claiming at Full Retirement Age in 2026 is $4,152 per month. The maximum benefit for someone who delays claiming until age 70 is $5,181 per month.

What is the maximum SSI payment in June 2026?

The maximum federal SSI payment in June 2026 is $994 per month for an individual and $1,491 per month for a couple, reflecting the 2.8% COLA applied in January 2026.

What time does Social Security direct deposit hit my bank in June 2026?

Direct deposits typically post in the early morning hours of the scheduled payment date, usually between midnight and 9:00 a.m. Eastern Time. The June 17 payment is not affected by the June 19 Juneteenth holiday.

What should I do if my Social Security payment is missing in June 2026?

Wait three business days after your scheduled payment date before reporting a missing payment. Then call the SSA at 1-800-772-1213, Monday through Friday, 8:00 a.m. to 7:00 p.m. local time. Do not call on Friday, June 19 — the SSA is closed for Juneteenth.

Was there an SSI payment in June 2025?

No. In June 2025, June 1 fell on a Sunday. The SSA issued the June 2025 SSI payment on Friday, May 30, 2025. June 2026 returns to a normal schedule with the SSI payment on Monday, June 1, 2026.

Key Takeaways: Social Security Payments June 2026

The Social Security Administration will distribute payments across five dates in June 2026. SSI recipients are paid on Monday, June 1. Pre-May 1997 beneficiaries are paid on Wednesday, June 3. All other retirement, SSDI, and survivor benefit recipients are paid on Wednesday, June 10, Wednesday, June 17, or Wednesday, June 24, based on their date of birth.

Juneteenth (Friday, June 19, 2026) does not delay or reschedule any payment. All SSA field offices and phone lines are closed on June 19. Recipients with pending matters should contact the SSA by Thursday, June 18, or use the My Social Security portal at ssa.gov.

June 2026 marks a return to a fully standard SSI schedule after the June 2025 anomaly, when SSI was paid on May 30 with no June payment. There are no bonus, extra, or double Social Security payments scheduled for June 2026.

All June 2026 payments include the 2.8% COLA that took effect January 1, 2026. The net monthly gain for the average retiree after the $17.90 Medicare Part B premium increase is approximately $38.10.

For the most current and personalized payment information, log in to your My Social Security account at ssa.gov or contact the SSA at 1-800-772-1213.