Social Security payments in 2026 increased by 2.8% due to the Cost-of-Living Adjustment (COLA), effective January 2026. The Social Security Administration (SSA) administers three distinct payment programs — retirement benefits, Social Security Disability Insurance (SSDI), and Supplemental Security Income (SSI) — each with a separate payment schedule. Payment dates depend on the program type and, for retirement and SSDI recipients, the beneficiary’s birth date.

Table of Contents

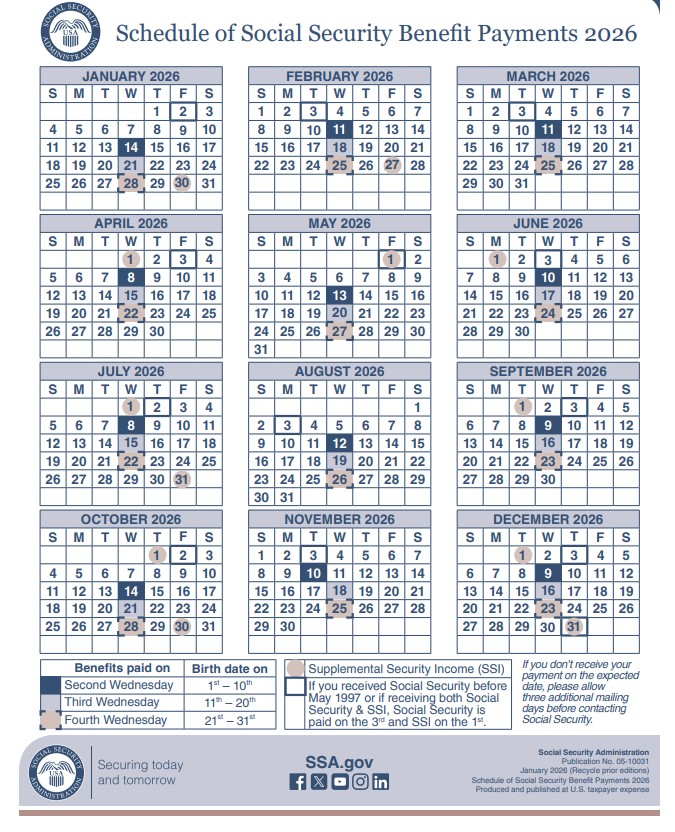

2026 Social Security Payment Schedule – Complete Date Calendar

Social Security payment dates in 2026 follow a structured system based on program type and birth date. The SSA distributes retirement and SSDI payments on the second, third, or fourth Wednesday of each month, determined by the beneficiary’s birth date. SSI payments go out on the first of each month, adjusted to the preceding business day when the first falls on a weekend or federal holiday.

Payment Date Rules – How the System Works

Four rules govern when each Social Security payment arrives in 2026:

- SSI (Supplemental Security Income): Paid on the 1st of the month. If the 1st falls on a weekend or federal holiday, payment moves to the preceding Friday.

- Pre-May 1997 recipients / Both SSI and Social Security: Paid on the 3rd of the month. If the 3rd falls on a weekend or holiday, payment moves to the preceding Friday.

- Birth date 1st–10th: Paid on the second Wednesday of the month.

- Birth date 11th–20th: Paid on the third Wednesday of the month.

- Birth date 21st–31st: Paid on the fourth Wednesday of the month.

2026 Social Security Payment Dates – Full Year Table

| Month | SSI Payment | Pre-1997 / 3rd-of-Month | Birth: 1st–10th (2nd Wed) | Birth: 11th–20th (3rd Wed) | Birth: 21st–31st (4th Wed) |

|---|---|---|---|---|---|

| January 2026 | Wednesday, December 31, 2025* | Friday, January 2, 2026* | Wednesday, January 14, 2026 | Wednesday, January 21, 2026 | Wednesday, January 28, 2026 |

| February 2026 | Friday, January 30, 2026* | Tuesday, February 3, 2026 | Wednesday, February 11, 2026 | Wednesday, February 18, 2026 | Wednesday, February 25, 2026 |

| March 2026 | Friday, February 27, 2026* | Tuesday, March 3, 2026 | Wednesday, March 11, 2026 | Wednesday, March 18, 2026 | Wednesday, March 25, 2026 |

| April 2026 | Wednesday, April 1, 2026 | Friday, April 3, 2026 | Wednesday, April 8, 2026 | Wednesday, April 15, 2026 | Wednesday, April 22, 2026 |

| May 2026 | Friday, May 1, 2026 | Friday, May 1, 2026* | Wednesday, May 13, 2026 | Wednesday, May 20, 2026 | Wednesday, May 27, 2026 |

| June 2026 | Monday, June 1, 2026 | Wednesday, June 3, 2026 | Wednesday, June 10, 2026 | Wednesday, June 17, 2026 | Wednesday, June 24, 2026 |

| July 2026 | Wednesday, July 1, 2026 | Thursday, July 2, 2026* | Wednesday, July 8, 2026 | Wednesday, July 15, 2026 | Wednesday, July 22, 2026 |

| August 2026 | Friday, July 31, 2026* | Monday, August 3, 2026 | Wednesday, August 12, 2026 | Wednesday, August 19, 2026 | Wednesday, August 26, 2026 |

| September 2026 | Tuesday, September 1, 2026 | Thursday, September 3, 2026 | Wednesday, September 9, 2026 | Wednesday, September 16, 2026 | Wednesday, September 23, 2026 |

| October 2026 | Thursday, October 1, 2026 | Friday, October 2, 2026* | Wednesday, October 14, 2026 | Wednesday, October 21, 2026 | Wednesday, October 28, 2026 |

| November 2026 | Friday, October 30, 2026* | Tuesday, November 3, 2026 | Tuesday, November 10, 2026** | Wednesday, November 18, 2026 | Wednesday, November 25, 2026 |

| December 2026 | Tuesday, December 1, 2026 | Thursday, December 3, 2026 | Wednesday, December 9, 2026 | Wednesday, December 16, 2026 | Wednesday, December 23, 2026 |

Notes:

- * = Payment moved to the preceding business day because the standard date falls on a weekend or federal holiday

- ** = Wednesday, November 11, 2026, is Veterans Day (federal holiday). The payment for birth dates 1st–10th moves to Tuesday, November 10, 2026

- Source: SSA 2026 Schedule of Social Security Benefit Payments (Publication No. 05-10031)

Social Security Payment Dates – Month-by-Month Detail

January 2026 Social Security Payment Dates

January 2026 SSI was paid on Wednesday, December 31, 2025, because Friday, January 1, 2026, is New Year’s Day, a federal holiday. The Social Security (3rd-of-month) payment moved to Friday, January 2, 2026, because Saturday, January 3, falls on a weekend.

Retirement and SSDI recipients in January 2026 received payments on:

- Wednesday, January 14, 2026 — birth dates 1st through 10th

- Wednesday, January 21, 2026 — birth dates 11th through 20th

- Wednesday, January 28, 2026 — birth dates 21st through 31st

February 2026 Social Security Payment Dates

February 2026 SSI was paid on Friday, January 30, 2026, because Sunday, February 1, 2026, falls on a weekend. This early payment explains why some SSI recipients appeared to receive two payments in January 2026 — one in late January for the January period and one in late January for the February period.

Retirement and SSDI recipients in February 2026 received payments on:

- Wednesday, February 11, 2026 — birth dates 1st through 10th

- Wednesday, February 18, 2026 — birth dates 11th through 20th

- Wednesday, February 25, 2026 — birth dates 21st through 31st

March 2026 Social Security Payment Dates

March 2026 SSI was paid on Friday, February 27, 2026, because Sunday, March 1, 2026, falls on a weekend. No SSI check arrives in March 2026 itself — the February 27 deposit covers the March benefit.

Retirement and SSDI recipients in March 2026 received payments on:

- Wednesday, March 11, 2026 — birth dates 1st through 10th

- Wednesday, March 18, 2026 — birth dates 11th through 20th

- Wednesday, March 25, 2026 — birth dates 21st through 31st

April 2026 Social Security Payment Dates

April 2026 follows the standard schedule with no adjustments required. SSI is paid on Wednesday, April 1, 2026. The 3rd-of-month payment falls on Friday, April 3, 2026.

May 2026 Social Security Payment Dates

In May 2026, both SSI and the 3rd-of-month payment are paid on Friday, May 1, 2026, because Saturday, May 2, begins the weekend and Sunday, May 3, is also unavailable. The 3rd-of-month payment moves from Monday, May 3 (not a holiday) — recipients who receive benefits on the 3rd receive their May payment on Friday, May 1.

Retirement and SSDI recipients in May 2026 received payments on:

- Wednesday, May 13, 2026 — birth dates 1st through 10th

- Wednesday, May 20, 2026 — birth dates 11th through 20th

- Wednesday, May 27, 2026 — birth dates 21st through 31st

June 2026 Social Security Payment Dates

June 2026 follows the standard schedule. SSI is paid on Monday, June 1, 2026. The 3rd-of-month payment is Wednesday, June 3, 2026.

July 2026 Social Security Payment Dates

July 2026 SSI is paid on Wednesday, July 1, 2026. The 3rd-of-month payment moves to Thursday, July 2, 2026, because Saturday, July 4, is Independence Day and the nearest available business day preceding July 4 is Thursday, July 2.

August 2026 Social Security Payment Dates

August 2026 SSI is paid on Friday, July 31, 2026, because Saturday, August 1, falls on a weekend.

November 2026 Social Security Payment Dates

November 2026 contains a holiday adjustment for the 1st–10th birth date group. The second Wednesday of November falls on November 11, which is Veterans Day, a federal holiday. The payment moves to Tuesday, November 10, 2026.

November 2026 SSI is paid on Friday, October 30, 2026, because Sunday, November 1, falls on a weekend.

2026 Social Security COLA – How Much Did Benefits Increase?

Social Security benefits increased by 2.8% in January 2026, as announced by the SSA in October 2025. This Cost-of-Living Adjustment (COLA) is based on the change in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) during the third quarter of the preceding year, as required by Section 215(i) of the Social Security Act.

2026 COLA Impact on Benefit Amounts

| Benefit Category | Average Monthly Benefit Before COLA (2025) | Average Monthly Benefit After COLA (2026) | Monthly Increase |

|---|---|---|---|

| Retired workers | $2,015 | $2,071 | +$56 |

| Disabled workers (SSDI) | $1,586 | $1,630 | +$44 |

| Aged couples (both receiving benefits) | $3,208 (approximate) | $3,297 (approximate) | +$89 |

| SSI – Individual | $967 | $994 | +$27 |

| SSI – Couple | $1,450 | $1,491 | +$41 |

Source: SSA COLA Fact Sheet, 2026.

The Medicare Part B Offset – Your Net COLA Increase

The 2.8% gross COLA increase does not translate to a full $56 monthly net increase for most recipients because Medicare Part B premiums are deducted directly from Social Security payments. The Medicare Part B standard premium rose to approximately $202.90 per month in 2026.

For a retired worker receiving the average benefit:

| Calculation Step | Amount |

|---|---|

| Average 2025 monthly benefit | $2,015.00 |

| 2.8% COLA gross increase | +$56.42 |

| Gross 2026 benefit | $2,071.42 |

| Medicare Part B premium 2026 (approximate) | −$202.90 |

| Medicare Part B premium 2025 | −$185.00 (approximate) |

| Net Medicare premium increase | −$17.90 |

| Approximate net benefit increase after Medicare | ~$38–$40 |

Recipients who are not enrolled in Medicare Part B receive the full gross COLA increase. The exact Medicare deduction varies by income level; higher-income beneficiaries pay Income-Related Monthly Adjustment Amounts (IRMAA) above the standard premium.

Historical COLA Comparison

| Year | COLA Percentage |

|---|---|

| 2022 | 5.9% |

| 2023 | 8.7% |

| 2024 | 3.2% |

| 2025 | 2.5% |

| 2026 | 2.8% |

Source: SSA COLA History page.

2026 Social Security Benefit Amounts – Retirement, SSDI, and SSI

Social Security benefit amounts in 2026 vary by program, claiming age, earnings history, and disability status.

Maximum Social Security Retirement Benefit in 2026

| Claiming Age | Maximum Monthly Benefit (2026) |

|---|---|

| Age 62 (early filing) | $2,831 |

| Age 67 (Full Retirement Age for those born in 1960) | $4,152 |

| Age 70 (maximum delayed retirement) | $5,251 |

Source: SSA Maximum Benefit amounts, 2026.

To receive the maximum benefit of $5,251 per month at age 70, a worker must have:

- Worked for at least 35 years

- Earned at or above the taxable maximum in each of those 35 years

- Delayed claiming until age 70

The maximum taxable earnings for 2026 are $184,500, up from $176,100 in 2025. Earnings above this threshold are not subject to Social Security payroll tax and do not factor into benefit calculations.

Average Social Security Benefit by Age – 2026

| Age at Claiming | Approximate Average Monthly Benefit (2026) |

|---|---|

| 62 | ~$1,298 |

| 63 | ~$1,357 |

| 64 | ~$1,467 |

| 65 | ~$1,612 |

| 66 | ~$1,784 |

| 67 (FRA) | ~$1,992 |

| 70 | ~$2,549 |

Average amounts are approximations based on SSA published data and vary significantly by individual earnings history.

SSDI Benefit Amounts in 2026

The average SSDI (Social Security Disability Insurance) payment in 2026 is approximately $1,630 per month for disabled workers, following the 2.8% COLA increase. SSDI benefit amounts are calculated using the same formula as retirement benefits, based on the worker’s Average Indexed Monthly Earnings (AIME) across their work history.

The Substantial Gainful Activity (SGA) threshold for 2026 — the maximum a non-blind SSDI recipient can earn from work before benefits are affected — is $1,690 per month.

SSI Benefit Amounts in 2026

The federal SSI payment standard for 2026 is $994 per month for an eligible individual and $1,491 per month for an eligible couple. SSI is a needs-based program funded by general federal tax revenues, not payroll taxes. It has separate eligibility rules, payment dates, and benefit calculations from Social Security retirement and SSDI.

| SSI Recipient Category | 2026 Federal Monthly Benefit |

|---|---|

| Individual | $994 |

| Couple | $1,491 |

| Essential person | $498 |

Some states supplement the federal SSI amount with additional state payments. The combined federal and state SSI benefit varies by state of residence.

SSI vs. SSDI vs. Retirement Benefits – Key Differences

SSI, SSDI, and Social Security retirement benefits are three separate programs administered by the SSA, with distinct eligibility requirements, payment sources, and benefit amounts.

| Feature | SSI | SSDI | Social Security Retirement |

|---|---|---|---|

| Eligibility basis | Financial need (income/assets) | Work history + disability | Work history + age |

| Funded by | General federal tax revenues | Payroll taxes (FICA) | Payroll taxes (FICA) |

| Minimum work history required | None | Yes (work credits) | Yes (40 credits / 10 years) |

| 2026 average monthly payment | $994 (individual) | $1,630 | $2,071 |

| Maximum 2026 payment | $994 (federal, individual) | Varies by earnings history | $5,251 (at age 70) |

| Payment date | 1st of month (adjusted) | 2nd/3rd/4th Wednesday (by birth date) | 2nd/3rd/4th Wednesday (by birth date) |

| Medicare eligibility | After 24 months of SSDI | After 24 months of SSDI | At age 65 |

| Medicaid eligibility | Typically automatic | Not automatic | Not automatic |

| Asset limit | $2,000 (individual) | None | None |

Can you receive both SSI and SSDI simultaneously? Yes, in limited cases. A person whose SSDI payment falls below the SSI income threshold may receive a partial SSI supplement to bring total monthly income closer to the SSI standard. This is called “concurrent benefits.”

2026 Social Security – Key Financial Limits and Thresholds

The SSA adjusts several financial figures annually for inflation. The following 2026 figures are sourced directly from the SSA’s official announcements.

| Financial Limit | 2026 Value | Change from 2025 |

|---|---|---|

| COLA increase | 2.8% | Up from 2.5% |

| Maximum taxable earnings (wage base) | $184,500 | Up from $176,100 |

| Earnings limit (under Full Retirement Age all year) | $24,480 | Adjusted for 2026 |

| Earnings limit (year reaching Full Retirement Age) | $65,160 | Adjusted for 2026 |

| Work credit earnings requirement | $1,890 per credit | Up from 2025 |

| SGA limit (non-blind SSDI recipients) | $1,690 per month | Adjusted for 2026 |

| SSI federal benefit (individual) | $994 per month | Up from $967 |

| SSI federal benefit (couple) | $1,491 per month | Up from $1,450 |

Source: SSA 2026 Fact Sheet.

Full Retirement Age in 2026 – The Born-in-1960 Milestone

People born in 1960 reach Full Retirement Age (FRA) of 67 in 2026. This is the highest FRA in Social Security history, a result of the 1983 Social Security Amendments that gradually raised FRA from 65 to 67 for anyone born in 1938 or later.

Full Retirement Age by Birth Year

| Birth Year | Full Retirement Age |

|---|---|

| 1943–1954 | 66 |

| 1955 | 66 and 2 months |

| 1956 | 66 and 4 months |

| 1957 | 66 and 6 months |

| 1958 | 66 and 8 months |

| 1959 | 66 and 10 months |

| 1960 and later | 67 |

Source: SSA Retirement Age page.

What Reaching FRA in 2026 Means for 1960 Birth Year

Three significant changes occur when a beneficiary born in 1960 reaches age 67 in 2026:

- Earnings test ends: Before FRA, benefits are reduced if earnings exceed $24,480 per year. After reaching the FRA, there is no earnings limit. A beneficiary can earn unlimited income without any benefit reduction.

- Benefit reduction penalty eliminated: Claiming before the FRA reduces monthly benefits permanently. At FRA, benefits are paid at 100% of the Primary Insurance Amount (PIA).

- Delayed retirement credits begin: Each month of delayed claiming beyond FRA earns an additional 0.667%, equivalent to 8% per year. Delaying from age 67 to age 70 increases monthly benefits by 24%.

Early vs. Delayed Claiming – Financial Impact for 1960 Birth Year

| Claiming Decision | Benefit as Percentage of PIA | Example Monthly Benefit (if PIA = $2,000) |

|---|---|---|

| Claim at age 62 | 70% of PIA | $1,400 |

| Claim at age 64 | 80% of PIA | $1,600 |

| Claim at age 66 | 93.3% of PIA | $1,867 |

| Claim at age 67 (FRA) | 100% of PIA | $2,000 |

| Claim at age 68 | 108% of PIA | $2,160 |

| Claim at age 69 | 116% of PIA | $2,320 |

| Claim at age 70 | 124% of PIA | $2,480 |

The break-even point between claiming at 62 versus 67 is approximately age 78–79 for most recipients, based on SSA actuarial tables. Beneficiaries who expect to live beyond this age typically receive more lifetime income by delaying.

Working While Receiving Social Security in 2026

Social Security retirement recipients who have not yet reached Full Retirement Age face an earnings limit in 2026. Exceeding this limit results in a temporary benefit reduction, not a permanent loss. Withheld benefits are recalculated and added back to monthly payments once the FRA is reached.

2026 Earnings Limits

| Situation | 2026 Annual Earnings Limit | Reduction Rule |

|---|---|---|

| Under FRA for the entire year | $24,480 | $1 withheld for every $2 earned over the limit |

| Reaching FRA during 2026 (months before birthday) | $65,160 | $1 withheld for every $3 earned over the limit |

| At or past FRA | No limit | No reduction |

Example Earnings Reduction Calculation

A retirement beneficiary who is under FRA for all of 2026 and earns $34,480 exceeds the $24,480 limit by $10,000. The SSA withholds $5,000 in benefits ($1 for every $2 over). If monthly benefits are $1,000, approximately 5 months of payments are withheld, after which regular payments resume.

Once FRA is reached, the SSA recalculates the monthly benefit to credit the withheld months, resulting in a permanently higher monthly payment going forward.

Why Did I Receive Two Social Security Payments in the Same Month?

Receiving two Social Security or SSI deposits in one month is not an error. It results from the SSA’s policy of moving payments to the preceding business day when the standard payment date falls on a weekend or federal holiday.

The following months in 2026 produce a “double deposit” effect for SSI recipients:

| Month | Reason for Early Payment | When Payment Arrives |

|---|---|---|

| January 2026 | January SSI moved to December 31, 2025 (New Year’s Day) | December 31, 2025 |

| February 2026 | February SSI moved to January 30, 2026 (February 1 is a Sunday) | January 30, 2026 |

| March 2026 | March SSI moved to February 27, 2026 (March 1 is a Sunday) | February 27, 2026 |

| August 2026 | August SSI moved to July 31, 2026 (August 1 is a Saturday) | July 31, 2026 |

| November 2026 | November SSI moved to October 30, 2026 (November 1 is a Sunday) | October 30, 2026 |

In these months, an SSI recipient sees two credits arrive in a single calendar month — one representing the current month’s benefit (paid on time) and one representing the following month’s benefit (paid early). The total annual payment amount does not change.

Social Security Payment – What to Do If You Did Not Receive It

If a Social Security payment does not arrive on the expected date, the SSA requests that beneficiaries wait 3 additional mailing days before taking action. Direct deposit payments are typically available the same day the SSA releases them. Mailed paper checks require additional delivery time.

Steps to Take for a Missing Payment

- Confirm the correct payment date: Verify the applicable payment date using the birth date table above or the official SSA payment schedule at SSA.gov

- Check bank or payment account: Log in to the bank account or Direct Express card account linked to the SSA for pending or posted transactions

- Wait 3 business days: For direct deposit, wait until the end of the third business day after the expected payment date

- Contact the SSA: If the payment has not arrived after the 3-day waiting period, contact the SSA at 1-800-772-1213 (TTY: 1-800-325-0778). SSA phone lines are open Monday through Friday, 8:00 AM to 7:00 PM local time

- Use My Social Security online account: Log in at SSA.gov to check payment status, confirm direct deposit details, and view payment history

Common reasons for delayed payments include:

- Incorrect or outdated direct deposit information on file with the SSA

- Bank processing holds on incoming government deposits

- Address changes that have not been updated with the SSA

- Payment offset by another federal agency for outstanding debts

Is Social Security Income Taxable in 2026?

Social Security benefits are subject to federal income tax in 2026 for recipients whose combined income exceeds the applicable threshold. The IRS defines combined income as Adjusted Gross Income (AGI) plus non-taxable interest plus 50% of Social Security benefits received.

Federal Tax Thresholds for Social Security Benefits – 2026

| Filing Status | Combined Income Range | Taxable Portion of Benefits |

|---|---|---|

| Single / Head of Household | Below $25,000 | 0% (no tax) |

| Single / Head of Household | $25,000 – $34,000 | Up to 50% of benefits taxable |

| Single / Head of Household | Above $34,000 | Up to 85% of benefits taxable |

| Married Filing Jointly | Below $32,000 | 0% (no tax) |

| Married Filing Jointly | $32,000 – $44,000 | Up to 50% of benefits taxable |

| Married Filing Jointly | Above $44,000 | Up to 50% of benefits are taxable |

Source: IRS Publication 915 (Social Security and Equivalent Railroad Retirement Benefits).

SSI is not subject to federal income tax. SSI payments are excluded from gross income under federal tax law.

State Taxes on Social Security Benefits

13 US states tax Social Security benefits to some degree as of 2026. These states include Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, Utah, Vermont, and West Virginia. Each state uses its own income thresholds and exemption rules. The remaining 37 states and the District of Columbia do not tax Social Security benefits at the state level.

How Social Security Benefits Are Calculated

Social Security retirement and SSDI benefits are calculated using the Primary Insurance Amount (PIA) formula, which is based on a worker’s Average Indexed Monthly Earnings (AIME) over their 35 highest-earning years.

Step-by-Step Benefit Calculation Process

- Record all earnings: The SSA records annual taxable earnings for each year a worker contributes payroll taxes

- Index earnings for inflation: Past earnings are adjusted to current wage levels using the National Average Wage Index

- Identify the 35 highest years: The SSA selects the 35 years with the highest indexed earnings. Years with zero earnings are included as $0 in the average

- Calculate AIME: Sum the 35 highest indexed annual earnings and divide by 420 (35 years × 12 months) to produce the Average Indexed Monthly Earnings

- Apply the PIA bend point formula: For 2026, the SSA applies the following formula:

- 90% of the first $1,174 of AIME

- 32% of AIME between $1,174 and $7,078

- 15% of AIME above $7,078

- Adjust for claiming age: The PIA is reduced for early claiming (before FRA) and increased for delayed claiming (up to age 70)

Workers can estimate their projected benefit by creating a My Social Security account at SSA.gov and accessing the Retirement Estimator tool.

Work Credits Required for Eligibility in 2026

Each Social Security work credit in 2026 requires $1,890 in earnings. A maximum of 4 credits can be earned per year. Most workers need 40 credits (10 years of work) to qualify for retirement benefits. SSDI requirements vary by age at the time of disability onset.

| Minimum Credits Needed | Purpose |

|---|---|

| 40 credits (10 years) | Retirement benefits |

| 6 credits in the last 3 years (for workers under 24) | SSDI eligibility (age-adjusted) |

| Varies by age at disability | SSDI – general rule: 20 of last 40 quarters for workers age 31 and older |

| 40 credits | Medicare Part A (premium-free) |

Survivor Benefits and Spousal Benefits in 2026

Social Security survivor benefits provide monthly payments to the eligible family members of a deceased worker. Spousal benefits allow a spouse to claim based on the other spouse’s earnings record.

Survivor Benefits – Who Qualifies

The following family members may be eligible for survivor benefits based on a deceased worker’s Social Security record:

- Surviving spouse: Age 60 or older (age 50 if disabled); or any age if caring for the deceased’s child under age 16

- Children: Unmarried children under age 18 (or under age 19 if still in high school); children of any age disabled before age 22

- Dependent parents: Age 62 or older who were dependent on the deceased for at least half of their financial support

The lump-sum death benefit is a one-time payment of $255, paid to the surviving spouse or, if no surviving spouse, to eligible children. This amount has not changed since 1954 and remains fixed under current law.

Spousal Benefits in 2026

A spouse who did not work or had lower lifetime earnings can claim up to 50% of the other spouse’s Full Retirement Age benefit. This is the spousal benefit maximum. The benefit is reduced for each month of claiming before the claiming spouse’s own FRA.

| Claimant Situation | Maximum Spousal Benefit |

|---|---|

| Claim at own FRA (age 67 for 1960 births) | 50% of worker’s PIA |

| Claim before own FRA | Reduced (proportional reduction to 35% minimum at age 62) |

Ex-spouses may also qualify for spousal benefits under the following conditions: the marriage lasted at least 10 years, the claimant is currently unmarried, both parties are age 62 or older, and the claiming ex-spouse is not entitled to a higher benefit on their own record.

Social Security Payments 2026 – Frequently Asked Questions

When are Social Security payments made in 2026?

Social Security retirement and SSDI payments are made on the second, third, or fourth Wednesday of each month, based on the beneficiary’s birth date. SSI payments are made on the first of each month, adjusted to the preceding business day if the first falls on a weekend or federal holiday.

How much will Social Security increase in 2026?

Social Security benefits increased by 2.8% in January 2026 due to the Cost-of-Living Adjustment (COLA). The average retired worker’s benefit rose from approximately $2,015 per month to approximately $2,071 per month.

Why did I get two SSI payments in the same month?

Two SSI deposits in one month occur when the SSA moves the following month’s payment to the preceding Friday because the first of that month falls on a weekend or holiday. The total annual benefit amount does not change. This happened for SSI recipients in February 2026 (February benefit paid January 30) and March 2026 (March benefit paid February 27).

What is the maximum Social Security payment in 2026?

The maximum Social Security retirement benefit in 2026 is $5,251 per month for a worker who claims at age 70. The maximum for those claiming at Full Retirement Age (67 for those born in 1960) is $4,152 per month. Achieving the maximum requires at least 35 years of earnings at or above the taxable maximum of $184,500.

Who gets Social Security on the 3rd of the month?

Recipients who began receiving Social Security benefits before May 1997 receive payment on the 3rd of each month. If the 3rd falls on a weekend or federal holiday, payment moves to the preceding business day. Individuals who receive both SSI and Social Security also fall under the 3rd-of-month schedule for their Social Security portion.

How much is SSI in 2026?

The federal SSI payment for 2026 is $994 per month for an eligible individual and $1,491 per month for an eligible couple. Some states add a supplemental payment to the federal amount.

Will a government shutdown affect Social Security payments in 2026?

Social Security and SSI payments continue during a federal government shutdown. The SSA operates on permanent, mandatory appropriations for benefit payments, which are not subject to annual spending bills. Administrative functions such as new applications, benefit adjustments, and office operations may be affected by a shutdown, but scheduled benefit payments continue.

What is the Social Security earnings limit for 2026?

The Social Security earnings limit for recipients under Full Retirement Age for all of 2026 is $24,480. The SSA withholds $1 in benefits for every $2 earned above this threshold. For those reaching FRA during 2026, the limit for months before the birthday month is $65,160, with $1 withheld for every $3 over the limit.

How many work credits are needed for Social Security in 2026?

Most workers need 40 credits (10 years of covered employment) to qualify for retirement benefits. Each credit in 2026 requires $1,890 in earnings, up to a maximum of 4 credits per year.

When does Social Security Direct Express deposit the payment?

Direct Express card deposits are typically available the same day the SSA releases the payment, which is the scheduled payment date listed in the official schedule. Some financial institutions may post the deposit one business day earlier or may hold funds briefly for verification.

Is Social Security taxable in 2026?

Social Security benefits are subject to federal income tax for individuals with combined income above $25,000 and married couples above $32,000. Up to 85% of benefits may be taxable at higher income levels. SSI is not subject to federal income tax.

What is the Full Retirement Age for people born in 1960?

The Full Retirement Age for individuals born in 1960 is 67. Those born in 1960 reach FRA during 2026 or 2027, depending on the specific birth month. At FRA, workers receive 100% of their Primary Insurance Amount and face no earnings test on work income.

2026 Social Security – Quick Reference Summary

| Category | 2026 Value |

|---|---|

| COLA increase | 2.8% |

| Average retired worker monthly benefit | $2,071 |

| Average SSDI monthly benefit | $1,630 |

| SSI maximum (individual) | $994/month |

| SSI maximum (couple) | $1,491/month |

| Maximum benefit at FRA (age 67) | $4,152/month |

| Maximum benefit at age 70 | $5,251/month |

| Maximum taxable earnings | $184,500 |

| Earnings limit under FRA (all year) | $24,480 |

| Earnings limit (year reaching FRA) | $65,160 |

| Work credit earnings requirement | $1,890 per credit |

| SGA limit (non-blind SSDI) | $1,690/month |

| Lump-sum death benefit | $255 (one-time) |

| Federal SSI income tax | Not taxable |

| Federal Social Security income tax | Up to 85% taxable above thresholds |

Disclaimer: This article presents information sourced from official SSA publications and the 2026 Social Security Benefit Payment Schedule (Publication No. 05-10031). It is not an official SSA communication. Verify all payment information directly at SSA.gov or by calling 1-800-772-1213.

All payment dates, benefit amounts, and financial limits in this article are sourced from the Social Security Administration’s 2026 Benefit Payment Schedule (Publication No. 05-10031), the SSA 2026 COLA Fact Sheet, SSA.gov, and IRS Publication 915. Readers should verify current figures directly with the SSA at SSA.gov or by calling 1-800-772-1213. This content is for informational purposes only and does not constitute financial, legal, or tax advice.